The oil producers group announced output increases of 411,000 barrels per day for May and June. Reuters

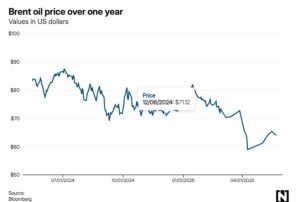

Oil prices were lower on Friday, heading for their first weekly loss in a month, after reports that Opec+ is planning to boost supply again in July.

Brent, the benchmark for two-thirds of the world’s oil, was down 0.65 per cent to $64.02 a barrel at 12.19am UAE time. West Texas Intermediate, the gauge that tracks US crude, shed 0.69 per cent to $60.78 per barrel.

The Opec+ group of producers, led by Saudi Arabia and Russia, had announced output increases of 411,000 barrels per day for May and June. It is likely to announce a similar increase for July during its June 1 meeting, Bloomberg quoted delegates as saying on Friday. However, no final decision has been made yet, the delegates added.

Meanwhile, demand prospects also remain uncertain amid trade tensions caused by the sweeping tariffs announced by the Trump administration, said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank.

“Either way, Opec+ appears less willing to cut supply to support prices … Geopolitical tensions alone are not enough to push prices sustainably higher – unless they escalate into something far worse, which we obviously don’t hope for.”

How Opec+ policy evolves during this year will depend on internal compliance issues and the broader developments in the oil market, analysts at Saudi Arabia’s Jadwa Investment said in its oil market update for May.

The group is likely to scale back production increases later in the year as global inventories start to increase.

“If Opec+ continues to accelerate production at the same rate as May-June, production in October 2025 would exceed the previous plan for October 2026. This could lead to substantial oversupply, taking into account expected gains in non-Opec+ oil production,” the analysts said.

For the producers in Opec specifically, a looser production strategy may be a good opportunity to place pressure on higher cost oil producers and win back some market share, with “the added benefit of bolstering good relations with the US given President Trump’s stated desire for lower oil prices”, the Jadwa analysts added.

The oil market faces continued uncertainty, awaiting the outcomes of a potential US-Iran nuclear deal and developments on American tariff negotiations with trading partners around the world, with a particular focus on talks with China.

The US and China, the world’s two biggest economies and main protagonists in the tariff war, agreed to a 90-day trade truce after a much-anticipated meeting in Geneva this month.

The two sides continued discussions on Thursday, an apparent signal of progress in efforts to reach a middle ground on tariffs.